Comparing accounting software can be tricky. Wave Accounting and QuickBooks are popular choices, each with free and paid options.

Choosing the right accounting software is crucial for your business. Both Wave Accounting and QuickBooks offer unique features in their free and paid plans. Understanding what each software brings to the table can help you make an informed decision. By comparing these options, you can determine which one fits your needs and budget best.

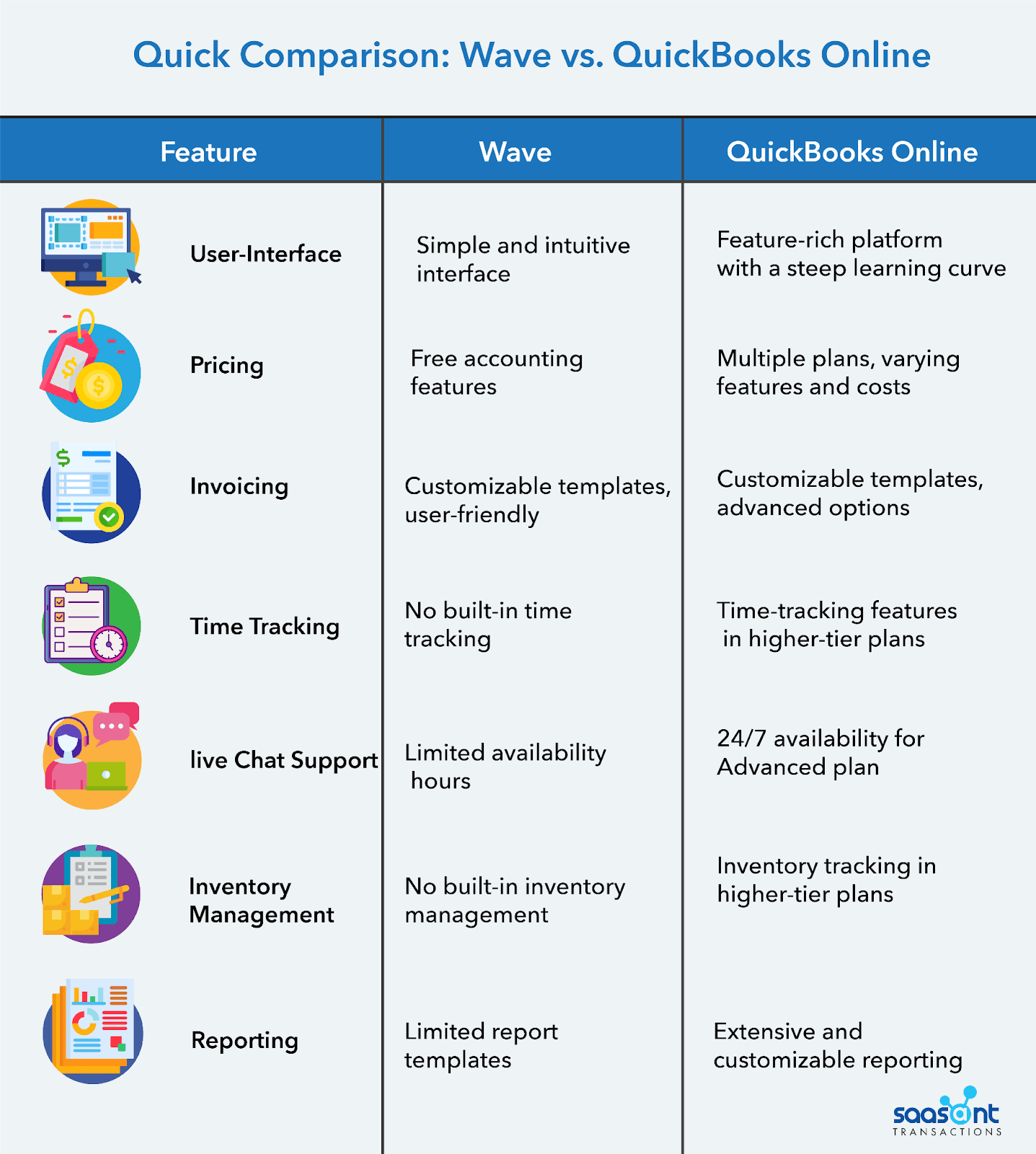

Let’s dive into the details and see how Wave Accounting and QuickBooks stack up against each other.

Introduction To Accounting Software

In today’s digital age, accounting software has become essential for businesses. It simplifies financial management, ensures accuracy, and saves time. Whether you run a small business or a large corporation, choosing the right accounting tool is crucial. This article will compare Wave Accounting and QuickBooks, highlighting their free and paid options.

Importance Of Choosing The Right Software

Selecting the right accounting software impacts your business efficiency. The right tool can streamline your financial tasks. It reduces errors and helps you stay compliant with tax laws. You can also make informed decisions based on accurate financial data. Hence, it is vital to choose software that meets your specific needs.

Overview Of Popular Accounting Tools

Several accounting tools are popular in the market. Wave Accounting and QuickBooks are among the top choices. Wave offers free accounting services tailored for small businesses. It includes features like invoicing, receipt scanning, and basic financial reporting.

QuickBooks, on the other hand, offers both free and paid options. The free version, QuickBooks Self-Employed, is ideal for freelancers. It includes expense tracking, mileage tracking, and basic reporting. The paid versions offer more advanced features, such as payroll management, inventory tracking, and detailed financial reports.

Credit: www.saasant.com

Wave Accounting Overview

Wave Accounting is a popular choice for small businesses. It offers a range of financial tools. These tools are designed to simplify accounting tasks. Wave is known for its free features. This makes it attractive for startups and small enterprises.

Features Of Wave Accounting

Wave Accounting provides several key features. These include invoicing and receipt scanning. You can create and send invoices easily. Track payments and manage your cash flow. Receipt scanning helps organize expenses. Simply take a photo of your receipt, and Wave does the rest.

It also offers bank reconciliation. This feature ensures your records match your bank statements. Wave Accounting integrates with your bank accounts. This allows for automatic transaction imports. You can also generate financial reports. These reports help you understand your business finances. Wave Accounting is cloud-based. This means you can access it from anywhere.

Benefits Of Using Wave

Wave Accounting has many benefits. First, it is free to use. This is a big advantage for small businesses. You do not need to spend money on software. It is easy to set up and use. You do not need accounting knowledge. Wave has a user-friendly interface.

It saves time. Automatic transaction imports and receipt scanning reduce manual work. You can focus more on your business. It also provides secure data storage. Your financial information is safe. Wave offers customer support. You can get help if you face any issues.

Wave Accounting is a comprehensive tool. It meets the needs of small business owners. It simplifies accounting tasks and helps manage finances effectively.

Quickbooks Overview

QuickBooks is a popular accounting software widely used by small to medium-sized businesses. It offers a range of features to manage finances efficiently. Both free and paid versions are available, catering to different business needs.

Features Of Quickbooks

QuickBooks offers many features to help manage your business’s finances.

- Expense Tracking: Easily track expenses and categorize them.

- Invoicing: Create and send professional invoices quickly.

- Payroll Management: Handle payroll and employee payments.

- Bank Reconciliation: Reconcile bank transactions easily.

- Reporting: Generate financial reports to analyze business performance.

Advantages Of Quickbooks

QuickBooks provides several benefits to its users, making it a preferred choice for many businesses.

- User-Friendly Interface: QuickBooks has an intuitive, easy-to-navigate interface.

- Scalability: It scales with your business, offering more features as you grow.

- Integration: Integrates with various third-party apps, enhancing functionality.

- Support: Offers reliable customer support for troubleshooting and queries.

To summarize, QuickBooks is a comprehensive tool for business accounting needs. Whether using the free or paid version, it provides essential features and advantages to streamline financial management.

Comparing Free Options

Choosing the right accounting software is crucial for small businesses. Both Wave and QuickBooks offer free versions. Each has its own set of features. Let’s compare the free options available with these two popular accounting tools.

Wave Free Version Features

Wave’s free version offers a range of features that cater to small business needs.

- Unlimited Invoicing: Create and send unlimited invoices without any charge.

- Expense Tracking: Track your expenses effortlessly with no limits.

- Receipt Scanning: Scan receipts and attach them to transactions.

- Multiple Currencies: Handle transactions in various currencies.

- Basic Reporting: Generate essential financial reports like profit and loss.

Wave’s free version is quite comprehensive. It covers the basic needs of most small businesses.

Quickbooks Free Version Features

QuickBooks also offers a free version. It’s called QuickBooks Self-Employed. This version is for freelancers and independent contractors.

- Expense Tracking: Track expenses and categorize them for tax purposes.

- Mileage Tracking: Automatically track mileage for business trips.

- Invoice Generation: Create and send invoices to clients.

- Tax Estimation: Estimate quarterly taxes to avoid surprises.

- Basic Reporting: Generate simple reports to understand your finances.

The QuickBooks free version is more limited compared to Wave. It is specifically designed for freelancers.

| Feature | Wave Free Version | QuickBooks Free Version |

|---|---|---|

| Invoicing | Unlimited | Limited |

| Expense Tracking | Unlimited | Limited |

| Receipt Scanning | Yes | No |

| Mileage Tracking | No | Yes |

| Tax Estimation | No | Yes |

| Reporting | Basic | Basic |

Overall, Wave offers more comprehensive features for small businesses. QuickBooks free version is more tailored to freelancers.

Comparing Paid Options

Choosing the right accounting software can be challenging. Comparing paid options can help you make an informed decision. Wave and QuickBooks offer different paid options, each with unique benefits. Understanding these can guide your choice.

Wave Paid Version Benefits

Wave’s paid version includes additional features that enhance user experience. Users get access to priority customer support. This ensures faster resolution of any issues. Payroll services are also available in the paid version. This helps businesses manage employee payments efficiently. Wave also offers advanced reporting features. This allows for better financial analysis and decision-making.

Quickbooks Paid Version Benefits

QuickBooks paid version provides a comprehensive set of features. Users enjoy advanced invoicing options, making billing easier. The paid version also offers enhanced inventory management. This helps businesses keep track of stock levels. QuickBooks provides time-tracking tools for project management. This improves productivity and billing accuracy. Additionally, the paid version includes robust tax management features. This simplifies tax filing and compliance.

Credit: zapier.com

Cost Analysis

Choosing the right accounting software can save money and time. Wave and QuickBooks offer free and paid plans. Each has different costs. Let’s break down these costs to find the best fit.

Free Vs Paid: Wave Costs

Wave offers a free accounting plan. This includes invoicing, accounting, and receipt scanning. The free version has no hidden fees. You pay for additional services. For example, payroll starts at $20 per month plus $6 per employee. Credit card processing fees are 2.9% plus 30 cents per transaction. Bank payments cost 1% per transaction. These are the main costs for Wave users.

Free Vs Paid: Quickbooks Costs

QuickBooks has free and paid options. The free version, QuickBooks Self-Employed, is very basic. It includes expense tracking and tax estimates. The paid plans offer more features. QuickBooks Simple Start costs $25 per month. It includes tracking income, expenses, and tax deductions. Essentials costs $50 per month. It adds bill management and time tracking. Plus costs $80 per month. This plan offers inventory tracking and project profitability. There is also QuickBooks Advanced for $180 per month. It suits larger businesses needing advanced features.

User Experience

User experience is crucial for any accounting software. It impacts how easily users can manage their finances. This section will compare the user experience of Wave Accounting and QuickBooks, focusing on ease of use.

Ease Of Use: Wave

Wave Accounting aims to be user-friendly. It has a clean interface. Users find it easy to navigate. The setup process is straightforward. You can connect your bank accounts easily. The dashboard shows key financial information at a glance. Invoicing is simple and quick. You can create and send invoices in a few clicks. Wave also offers helpful guides. These resources assist users in getting started.

Ease Of Use: Quickbooks

QuickBooks offers a robust user experience. The software is feature-rich yet intuitive. New users get a guided setup process. This helps in configuring essential settings. The dashboard is comprehensive. It displays financial data clearly. QuickBooks simplifies tasks like invoicing and expense tracking. Users can create professional invoices easily. The mobile app adds more convenience. You can manage finances on the go. QuickBooks also provides tutorials. These help users to utilize various features effectively.

Final Verdict

The battle between Wave Accounting and QuickBooks is a tough one. Both offer free and paid options, catering to different needs. Deciding which is better depends on your business’s current stage and future goals.

Best Choice For Small Businesses

Wave Accounting shines as the best choice for small businesses. Its free option provides essential features without hidden costs. This includes invoicing, accounting, and receipt scanning. Small businesses often operate on tight budgets. Wave helps them save money while maintaining essential financial operations. The user-friendly interface makes it easy for non-accountants to manage finances.

Best Choice For Growing Businesses

QuickBooks stands out for growing businesses. Its paid plans offer advanced features crucial for scaling. These include inventory tracking, project management, and robust reporting. Growing businesses need more than just basic accounting. QuickBooks provides tools to handle complex financial tasks. Paid options ensure that as your business grows, your accounting software keeps pace. It also integrates with many third-party apps, enhancing its functionality.

Credit: practice.do

Frequently Asked Questions

What Is The Difference Between Wave Accounting And Quickbooks?

Wave Accounting offers free basic accounting tools, while QuickBooks provides more advanced features, but at a cost.

Does Wave Accounting Offer A Free Option?

Yes, Wave Accounting offers a free option for its basic accounting tools.

Is Quickbooks Worth The Cost?

QuickBooks is worth the cost for businesses needing advanced features and integrations that Wave’s free version lacks.

Can I Use Quickbooks For Free?

QuickBooks offers a free trial, but generally, it is a paid service with various pricing plans.

Conclusion

Choosing between Wave Accounting and QuickBooks depends on your needs. Wave offers great free tools for small businesses. QuickBooks provides both free and paid options with more features. Consider your budget and requirements. Both platforms can help manage your finances.

Evaluate their features and decide which fits best. Your business deserves the right accounting tool. Make an informed choice for better financial management.